📦 TA-Lib Python Wrapper: Overview

This is a high-performance Python interface for the widely-used TA-Lib (Technical Analysis Library), which provides tools for analyzing financial market data. Its key advantage is that it uses Cython instead of the original SWIG bindings, making it easier to install and 2-4 times faster.

⚙️ Core Features & Capabilities

-

Comprehensive Indicators: Offers 150+ technical indicators across all major categories:

-

Overlap Studies (e.g., Moving Averages, Bollinger Bands)

-

Momentum Indicators (e.g., RSI, MACD, Stochastic)

-

Volume Indicators (e.g., OBV)

-

Volatility Indicators (e.g., ATR)

-

Cycle Indicators, Price Transforms, Statistic Functions, and Pattern Recognition.

-

-

Candlestick Pattern Recognition: Includes a vast library for identifying patterns like Doji, Engulfing, Morning Star, etc. (listed under "Pattern Recognition").

-

Dual API Design:

-

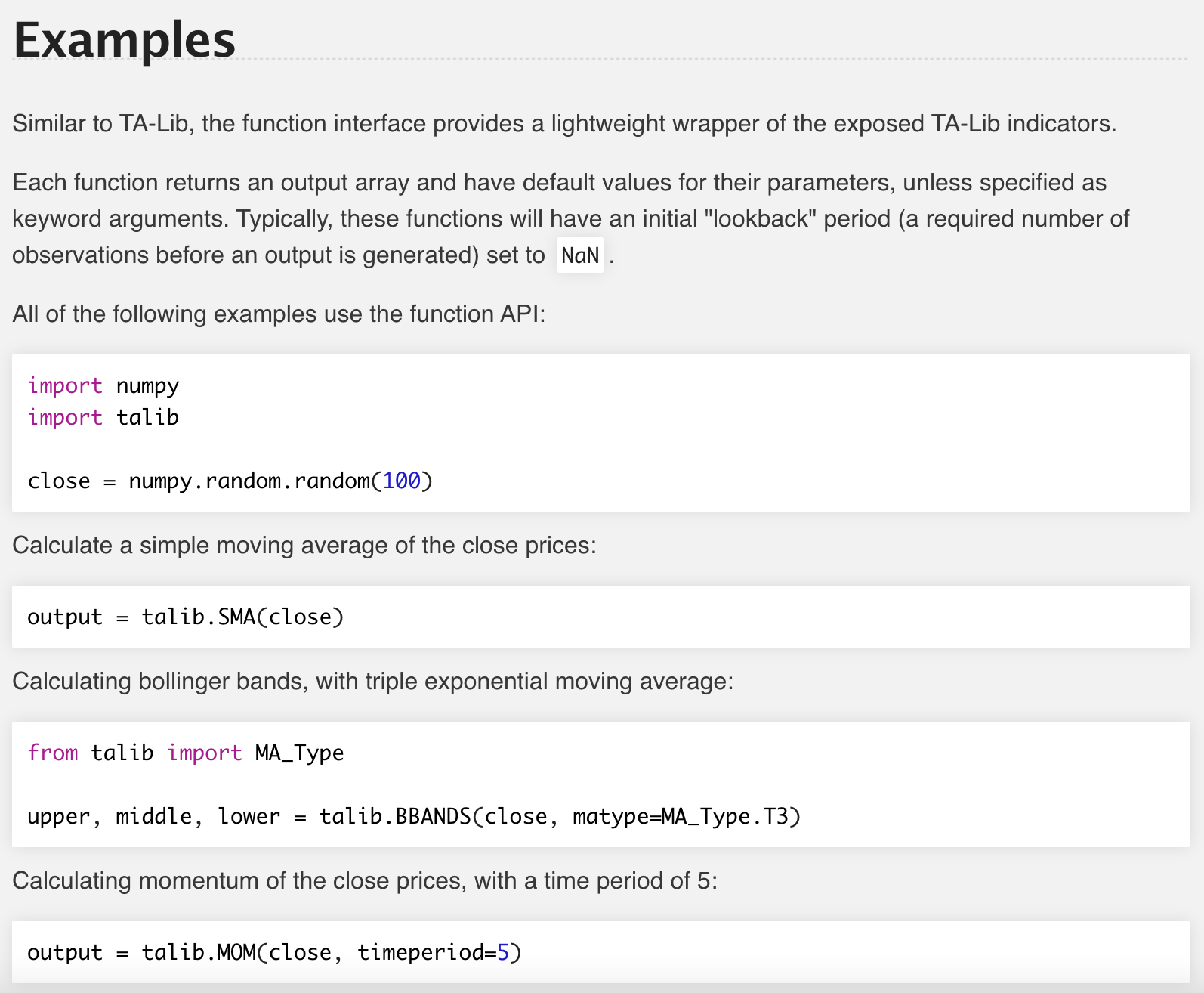

Function API: Lightweight, direct function calls (e.g.,

talib.SMA(close)). -

Abstract API: Object-oriented approach that uses a dictionary of price arrays, offering flexibility in specifying which price column (e.g.,

open,high) to use for calculations.

-

💻 Key Technical Details

-

Foundation: Efficiently binds to the underlying TA-Lib C library using Cython and NumPy.

-

Output: Functions typically return NumPy arrays. Initial "lookback" periods may be filled with

NaN. -

Use Case: A fundamental tool for developers and quants building trading strategies, backtesting systems, or market analysis tools in Python.

In essence, this library is the go-to, high-speed Python toolkit for implementing technical analysis in automated trading systems and financial research. It is a core dependency for many trading frameworks, including Freqtrade, which we previously discussed.

Pionex: Leading Trading Bot Platform in the World